DB SCHENKER Singapore & Malaysia Cluster Exclusive

Red Sea / Gulf of Aden Situation Updates

Updates:

Published Date - 5 Jan 2024

Global Market Development and Suez Crisis Update

Key Summary:

- Status update on Suez Crisis

- Restrictions in Panama Canal eased slightly

- Rates have gone up and are expected to increase further

The situation at the Red Sea continues with a direct impact on major trade routes, including Asia to/from Europe (NCP and Med), Europe and North America to/from the Middle East (Red Sea, Arab Gulf), Asia and the Middle East to North America, and Asia to/from the Red Sea. Although restrictions in the Panama Canal have eased slightly since 24 January, there is still a daily limitation of 24 vessels. The consequences of these disruptions remain extensive.

More info on the market development and rate trend can be found here:

Published Date - 3 Jan 2024

Red Sea Uncertainties Driving Up Costs in Container Shipping and Labor

Key Summary:

- Majority of shipping lines taking the longer route via the Cape of Good Hope

- Expected delay of 1 week and more

- Equipment shortages in the coming months

- Shipping lines implements surcharges to offset additional operational costs

In recent times, heightened attention has been directed towards the southern Red Sea and the Bab al-Mandeb Strait, primarily owing to the increasing incidents of vessel attacks orchestrated by Yemen's Houthi movement. This poses a significant challenge for the global shipping and logistics industry, giving rise to operational disruptions, volatile pricing dynamics, sustainability considerations related to extended detours, and an urgent need for adaptations in operational planning.

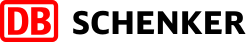

The majority of the shipping lines have already chosen to take a lengthier route via the Cape of Good Hope instead of their usual path through the Red Sea and Suez Canal. We expect a rise of approximately one week in transit durations for Asia to Europe routes redirected through the Cape of Good Hope, which traditionally relied on the Suez Canal. Similarly, South Asia to the Europe/US East Coast routes (Westbound) may experience an extension of around 10-14 days. This also means that the return voyage from Europe/USEC will have the same delay of 10-14 days into their voyage causing interruption of the planned schedule in the Asia/Australia Region. The increase in distance travelled will mean longer transit time which will impact sailing schedules and service reliability, leading to delays.

Vessel reshuffling is happening across Asia region as vessel schedules are affected by the long haul vessel. We may also foresee equipment shortage in the coming months where empties repositioning is unable to catch up with the demand in the market.

Given the cumulative impact on all vessels, the recent events have the potential to substantially influence the global supply chain, introducing delays, increased costs, and heightened emissions. Most shipping lines implemented supplementary surcharges to offset these additional costs for Asia-Europe/US/CA Trade.

Key Summary:

- Carriers are suspending transit via the Red Sea

- Drought in the Panama region led to the implementation of daily vessel limits in the Panama canal

- Panama Canal surcharge introduced by carriers

- Expect delays and increased rates

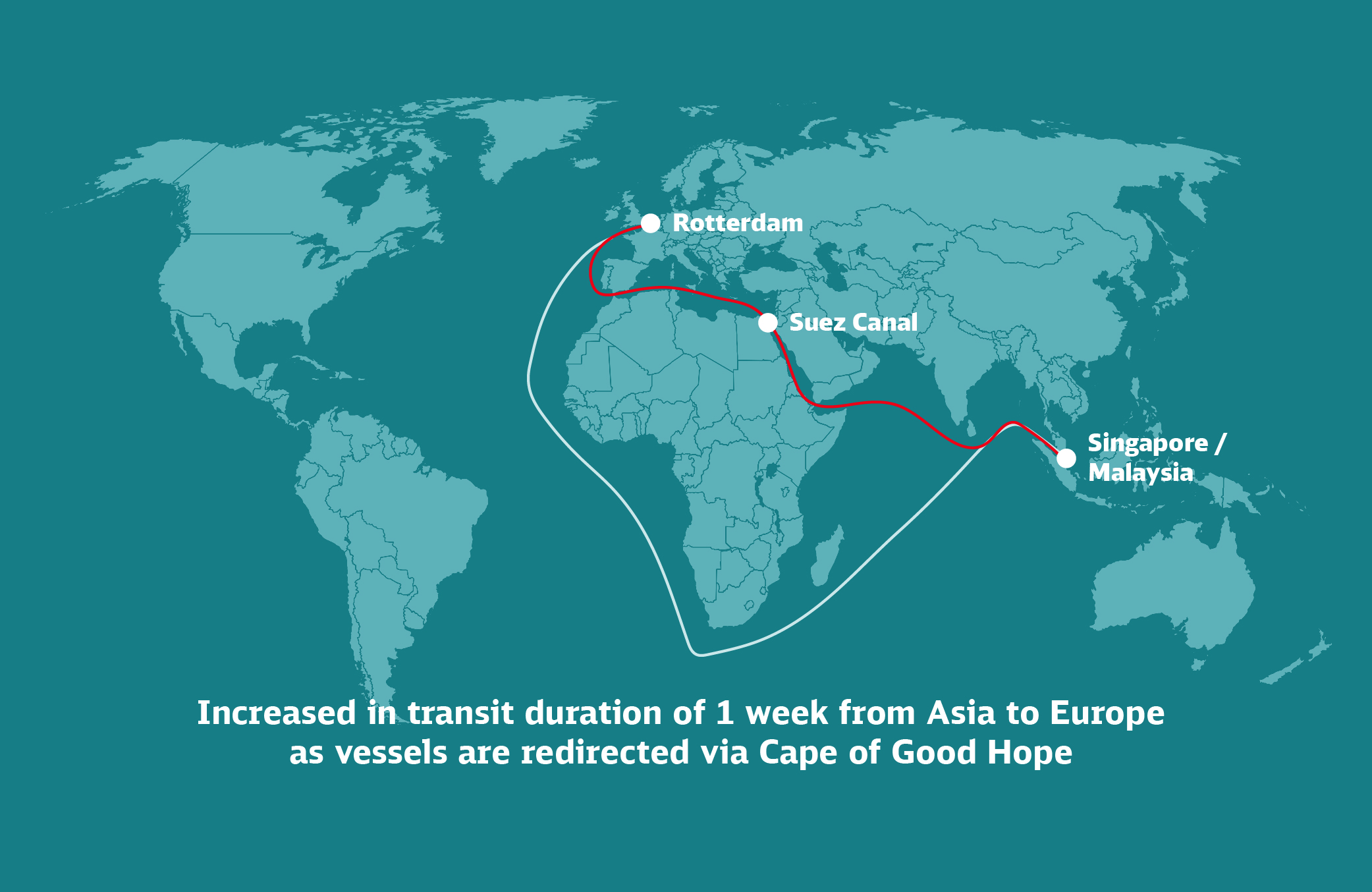

Red Sea Attacks

As the safety situation worsens, carriers are implementing precautionary measures to avoid Suez Canal and the Red Sea, and instead reroute their vessels around Cape of Good Hope.

ZIM, MSC, Maersk, CMA CGM, Hapag-Lloyd, and HMM have announced that they will suspend transit via the Red Sea. We are anticipating more carriers to follow suit. This re-routing will prolong transit times.

Panama Canal

Authorities had implemented a daily vessel limit as the canal’s water levels were strained by the reduced rainfall in the region. Additionally, a Panama Canal Surcharge is being introduced by carriers. Recent news indicates that the daily ship limit will be eased slightly in January due to better-than-expected November rainfall. Vessels avoiding the longer waiting times and fees at Panama Canal will likely take the longer route around Cape of Good Hope due to the rising threats around the Red Sea.

Impact on your shipments

The Red Sea's current challenges coupled with Panama drought are causing widespread disruptions in the shipping industry. Rerouting and longer transit durations are contributing to extended delays, while increased rates stem from surcharges and higher operational costs incurred during prolonged waiting times. Anticipated bottlenecks may arise in port congestions, particularly in Q1 2024, as vessels accumulate upon arrival. Additionally, equipment shortages are expected due to the extended transit times.

Subscribe to receive our market updates!

Navigate the complexities of the ocean freight landscape with confidence. Get timely updates on extended delays, rate fluctuations, and industry trends to make informed decisions and stay ahead of the competition.

Global Ocean Freight

From full containers (FCL) to consolidation (LCL) and reefer management, we offer cost-effective logistics solutions designed to meet all your sea transport needs.

DB SCHENKER | connect

Discover a simplified booking experience with our easy-to-use platform for ocean freight. Get instant quotes, book directly online, and easily track your shipments.

About DB SCHENKER Singapore & Malaysia

Over 50 years of established presence in Singapore and over 45 years in Malaysia. Our global network and advanced logistics solutions ensures maximum flexibility and efficiency for all your supply chain needs.

We are an integrated lead logistics provider, specializing in Air/Ocean Freight, Land Transport, and Contract logistics. Our drive for innovation and sustainable solutions ensures your supply remains resilient and competitive.